This post contains affiliate links. That means if you click and buy something, I may earn a small commission at no extra cost to you.

Are you tired of working hard and still feeling like your money disappears too fast?

As a mom, you do so much for your family.

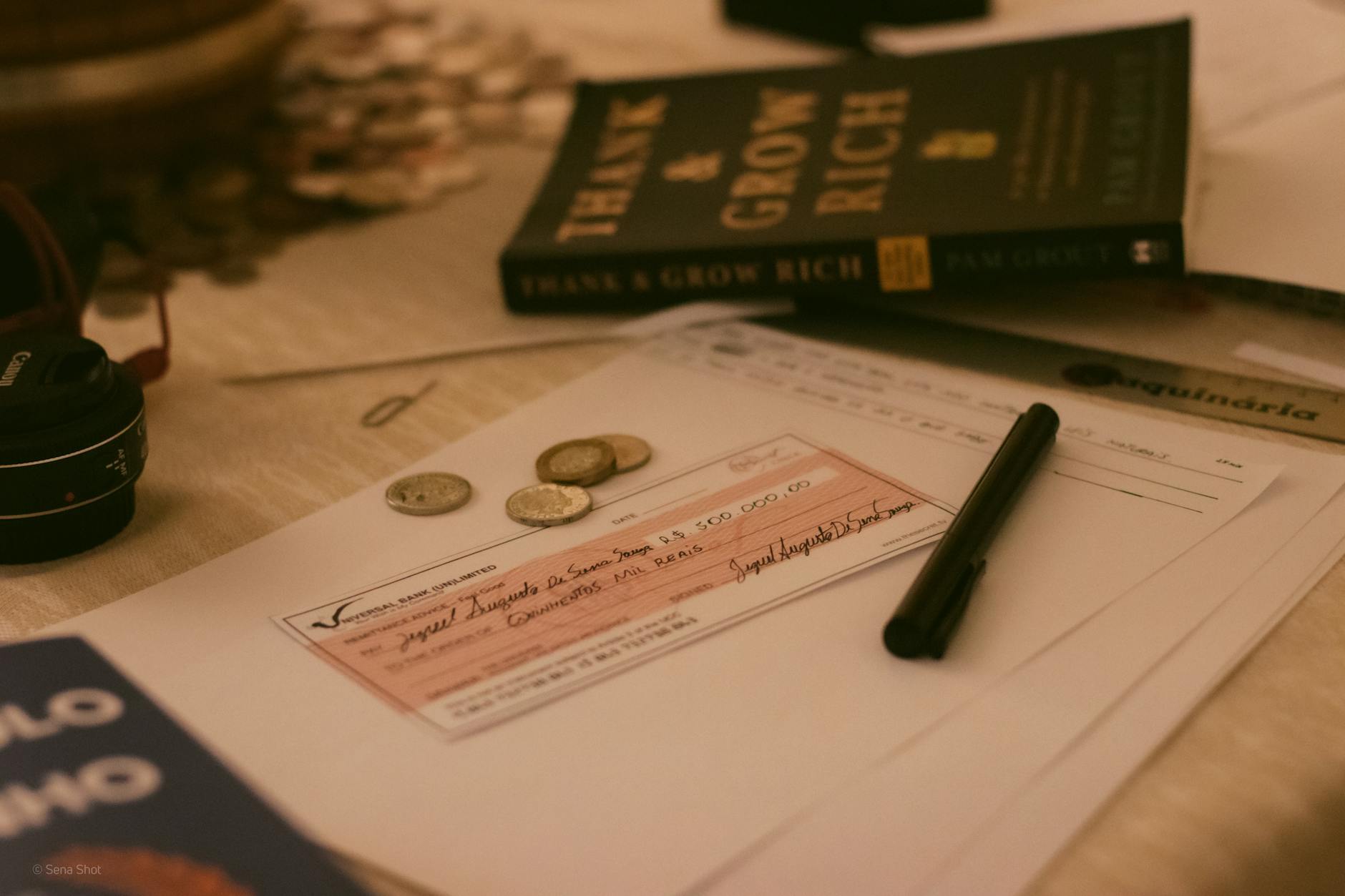

What if your money could start working for you too?

Let’s talk about how to make money in smarter ways—even if you’re starting with a regular job.

Start With What You Have: Earned Income

Earned income is the money you make from your job.

This is where most moms start.

It’s what pays for food, clothes, and bills.

But here’s the secret: you don’t want to only earn and spend.

You want to earn and save—and then grow your savings into more money.

Let’s look at 8 income streams that can help you stop living paycheck to paycheck:

- Earned Income – This is your job. It’s the first step.

Use it to save, not just spend. Using a Budget Planner for Moms can make it easy to track your spending and savings. - Profit Income – Make money by buying and selling.

Example: Buy kids’ clothes on sale and sell them online for more. - Interest Income – Make money by letting others borrow your money.

Example: Use a savings app or bank that gives you interest. If you’re new to this, High-Yield Savings Account Books can guide you step-by-step. - Residual Income – Keep getting paid after the work is done.

Example: Make a course or write an ebook once, and people keep buying it. - Dividend Income – Make money by owning stocks.

Even small apps let you buy tiny pieces of stock and get paid just for owning them. - Rental Income – Make money by renting out property.

You don’t need to buy a house right away. You can start by renting a room or even tools you own. - Capital Gains – Make money when things you own go up in value.

Buy something smart (like land or art), wait, and sell it for more later. - Royalty Income – Make money from your ideas.

Write a book, a song, or even design a T-shirt. If people use it, you get paid!

How to Make This Work for You, Mom

Start with your job (earned income).

Don’t use it all. Save some each month.

Next, use that saved money to invest in other income streams—like stocks (dividends), selling items (profit), or renting out something you own (rental income).

Let those income-producing assets make money for you.

Then, once your assets are making enough money, use that extra income to buy the fun stuff—like vacations, clothes, or a new car.

Final Tip for Moms

You work hard.

Now let your money work too.

Start small. Save from your paycheck. Build one income stream at a time.

Soon, you’ll stop living paycheck to paycheck—and start living with peace of mind.

📢 What’s Next? → Want to learn more ways to make money from home? Click here to join my newsletter!

💬 Join My Community → Come share your side hustle wins with other amazing women in my Facebook group!

🛍 Shop My Merch → Shop The4AMerch here

💼 Work With Me → Looking for a side hustle? Let’s Partner Together